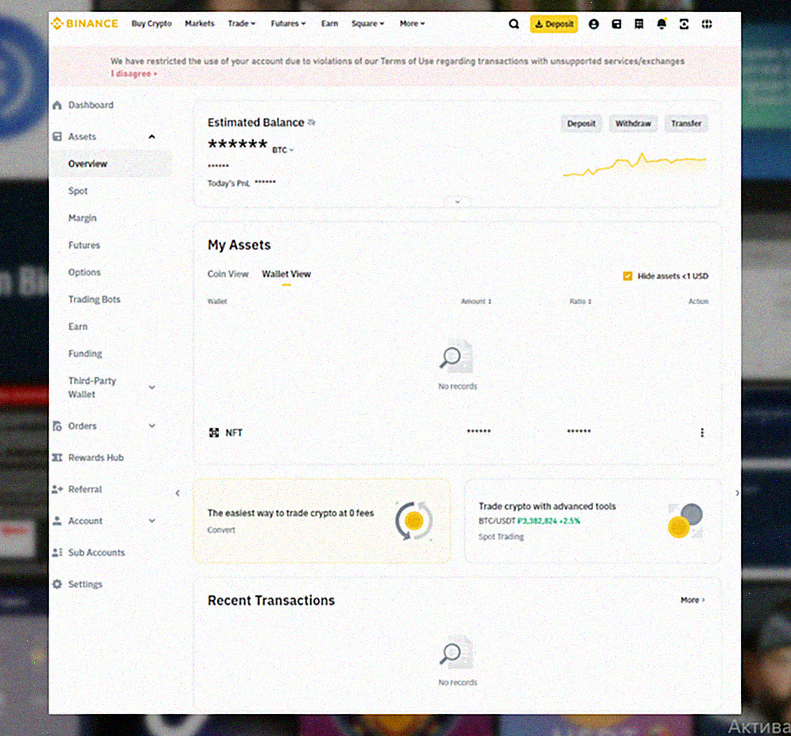

I conduct all my crypto activities according to the rules: KYC has been passed, I have been trading for a long time, everything is clean with the tax. I thought the blocking issues wouldn’t affect me. Until my client, let’s call him John, contacted me with a completely blocked account on a major stock exchange. His story became my personal case, which completely changed my understanding of security in crypto.

This instruction is the result of that debriefing. I’m not just going to tell a story, but I’m going to give you a ready-made plan of action that worked for me and will work for you if you encounter the brutality of automated compliance systems.

How I figured out the reasons: sanctions are a reality, not an abstraction

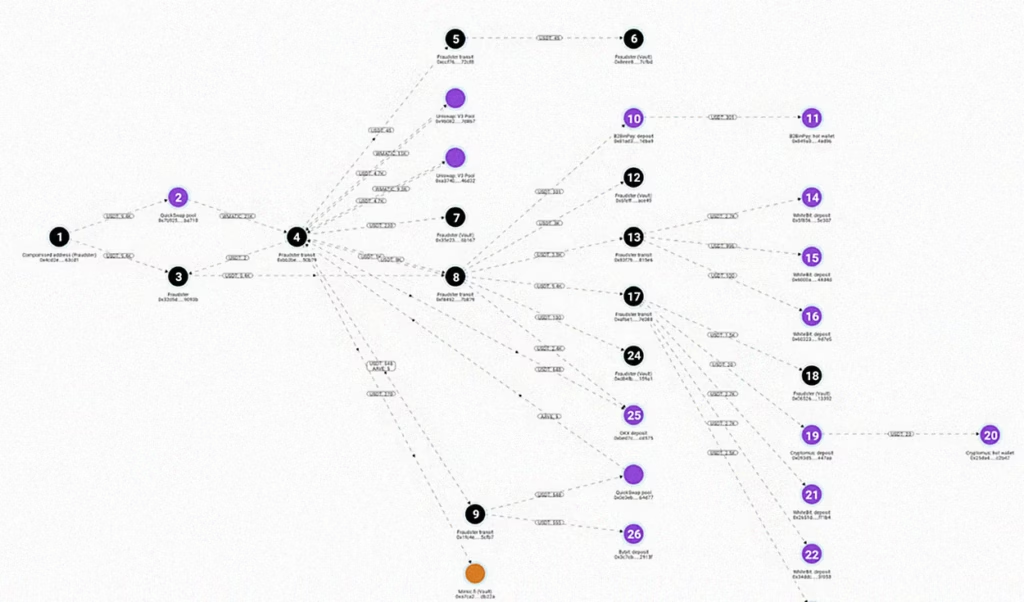

The first step to solving any problem is to understand its root. John story was classic: he received a transfer from a friend who did not know that his wallet was “tainted” by connection with an illegal platform.

What I learned about sanctions in 2025: These are not just lists of “bad guys.” These are dynamic databases:

My main discovery: Exchanges are required to do this. Their license is subject to compliance with the FATF (Inter-Agency Group for the Development of Anti-Money Laundering Measures) regulations. The fines amount to billions, so their Compliance departments are not joking. Any transaction, incoming or outgoing, is scanned in real time.

My advice for 2025: Stop thinking that crypto is anonymous. This is the biggest myth that breaks the fate of accounts. All your transactions are transparent and calculated.

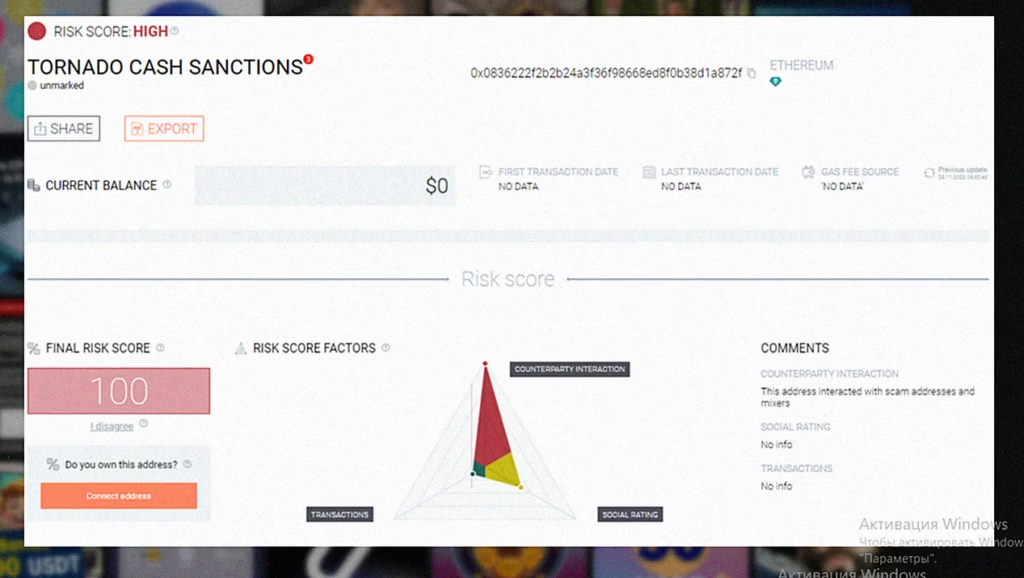

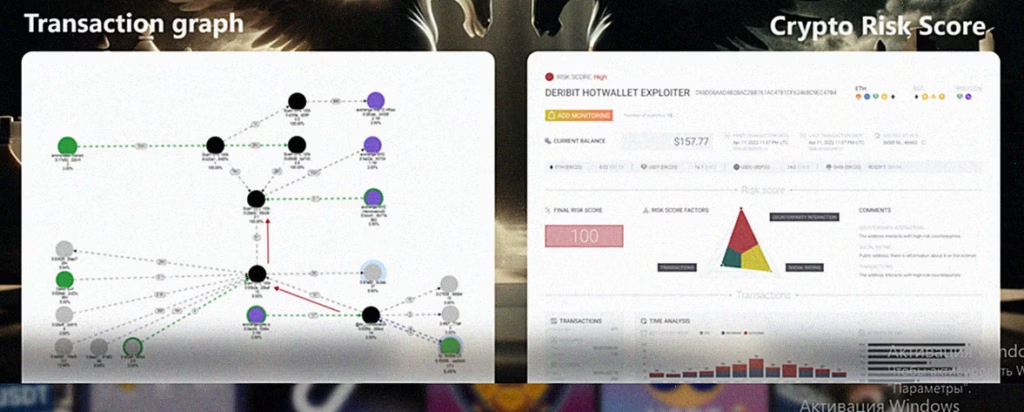

Risk Score: what is it and how do I check every address now

Risk Score is not an assessment of your account on the stock exchange. This is an assessment of the reputation * of a particular blockchain address* on the network. Imagine that this is the “credit rating” of the wallet. The exchange simply sees that you have received funds from an address with a bad “credit history” and blocks you by association.

How I explain it to clients on my fingers:

This is how a dangerous address looks in the Btrace service. A high Risk Score is the main signal for the immediate termination of any operations with it.

The most important conclusion I’ve made: The risk is not in what you do, but in what your counterparties do. Your safety depends on the vigilance of those who transfer money to you.

My algorithm of actions when blocking: 3 steps to unblocking

When this happened to my client, I didn’t let him panic. We acted according to a clear plan, which I now apply to all such cases. Here he is.

Step 1: Make good first contact with customer support

No aggression. Your goal is to show yourself as an adequate user who wants to help solve the problem. I have compiled a template for John that you can safely use.

Support request template (copy and use):

Theme: Account access restriction [your ID/email]. Willingness to cooperate

Text:

Hello!

My account [login or e-mail] has been blocked. I have not received notifications about the reasons and I want to promptly eliminate possible violations.

I suspect that the lock could be related to the transaction [TXID or hash of the operation, if known] from the address [sender’s wallet address]. I am ready to provide any necessary evidence of the origin of the funds (receipts, screenshots, sender’s contacts) to resolve the issue as soon as possible.

Please provide me with information about further actions to unlock the account.

Sincerely,

[Your name]

Why this template works: It is structured, polite, and shows that you are not a scammer, but a conscious user in a difficult situation. This removes 80% of suspicion immediately.

Step 2: Independent audit of transactions (we do it ourselves or call experts)

While you’re waiting for an answer, don’t waste any time. Analyze your transfer history:

What I did for John: We didn’t guess. I immediately connected the AML Crypto service. Their algorithms performed a complete auction of the transaction chain, found a “dirty” address, and we were able to compile a legally competent response for support. It saved weeks of time. Sometimes it’s better to pay experts than to lose all your money.

Important addition for 2025: Be prepared for the request Proof of Source of Funds (Confirmation of the source of funds). Prepare it in advance:

Step 3: Prepare for the worst, but hope for the best

In 99% of cases, if you are not a deliberate criminal, your account will be unblocked. But there is 1% when the block is initiated by the regulator (for example, OFAC in the USA). Only contacting a lawyer specializing in cryptography will help here.

My comprehensive checklist for 100% lock protection

After this incident, I developed ironclad rules for myself and my clients. Use it.

Table: Where and why to withdraw funds

Checklist before ANY transaction (print it out!)

My main rule after this incident: I withdraw from the exchange everything that I do not plan to trade in the next 24 hours. The stock exchange is a store, not a safe. Your safe is your personal wallet.

Bottom line: don’t be an easy prey for algorithms

The story of my client John ended well. After 11 days and several clarifying emails, his account was unblocked. But those 11 days cost him thousands in lost profits and ruined nerves.

Now I check every address, even if they transfer me $5. Because the price of a mistake is not $5, it is the value of all assets on my exchange platform.

Your security in the crypto world is not a sophisticated technology. It’s a habit. The habit of checking and rechecking.

A reminder from me for 2025: The tools change, but the essence remains. Make a habit: no address verification, no transaction. This is just as important as two-factor authentication.

Act now: Open your recent transaction history and check the addresses you have been working with. Are you 100% sure of their purity?

Questions and answers: We analyze the nuances of blocking cryptocurrency accounts

1. What should I do if the exchange’s support does not respond to my application?

This is a common situation. The main thing is not to spam the chat, it will only delay the decision. My strategy is to send a clearly written ticket (as in the article) and wait 3-5 business days. If there is no response, find the official support chat on Telegram or Twitter (X) of this exchange and politely write there, specifying your ticket number. Public channels are often faster. If this does not help, the next step will be to file an official complaint with the financial ombudsman or the regulator of the jurisdiction where the exchange is registered (for example, for Binance, this is VARA in Dubai).

2. I was just trading on the stock exchange and did not withdraw funds anywhere. Why can I be blocked?

The automatic compliance system scans not only withdrawal, but also incoming transactions. If you bought USDT through a P2P platform from an unscrupulous seller who financed prohibited activities, his “dirty” address will be linked to your account. Even if you were just actively trading on the spot market, large volumes may raise suspicion of money laundering, and the algorithm may require manual verification of your account.

3. The address’s Risk score was low, but I was blocked anyway. Why?

Various analytics services (Chainalysis, Elliptic, Btrace) and the exchanges themselves use their own, constantly updated risk assessment algorithms. An address may have a low score in one service, but may be sanctioned in another database to which your exchange is connected. In addition, it may not be the address itself that causes the block, but suspicious activity: sudden volume spikes, arbitrage between platforms, or trading at an uncharacteristic time for your region.

4. Is it necessary to use paid services ? Or is it possible to make do with free analogues?

For a one-time verification of the address before the transaction, free services (Btrace, HashScan) are usually enough. Their capabilities are sufficient to identify obvious threats. But if your account is already blocked, I strongly recommend contacting professionals. Paid services perform in-depth analysis of the chains, have direct channels of communication with the compliance departments of exchanges and know how to properly submit information. Their service is an investment in saving all of your funds, not just a portion of them.

5. If my account is unblocked, will I still have a “black mark”?

Unfortunately, yes, there is such a chance. The exchange’s internal system may mark your account as “verified” or “under investigation.” In practice, this may mean closer attention to your future transactions, more frequent requests for verification of income sources, or a longer manual verification process when withdrawing large amounts. That is why, after unblocking, I advise you to immediately withdraw your main assets to a cold wallet.

6. I only use DEX (decentralized exchanges). Should I be afraid of locks?

No one will block you at the DEX smart contract level (Uniswap, PancakeSwap). However, your risk is shifting. If you use a centralized exchange for replenishment (to buy USDT, and then withdraw it to MetaMask), then the rules of the game are the same: your address in the blockchain will be checked by the exchange during withdrawal. If you have withdrawn to a “dirty” address, your CEX account will be blocked. Your assets on DEX are safe, but the fiat entry/exit (on/off ramp) always remains a vulnerable point.