The crypto market isn’t just moving fast—it’s moving at light speed. To not just survive but thrive, you need the right tools in your arsenal. Whether you’re a day trader glued to charts, a long-term investor digging into token fundamentals, or just trying to see where the whales are swimming, quality research tools make all the difference. But not all platforms are created equal. Some offer flashy dashboards with superficial data. Others hide gold beneath layers of complexity.

This guide cuts through the hype: We break down the best crypto market analysis tools for 2025 so you spend less time digging and more time taking smart action. We’ve not only updated the data but added key trends of the year, such as AI analytics, tools for RWA (Real World Assets), and decentralized ratings.

Key Updates for 2025

- Top Tools 2025: Alongside established players like Glassnode (institutional on-chain analytics), Nansen (“smart money” tracking), Arkham (deanonymization), CoinGecko/CoinMarketCap (aggregators), LunarCrush (social sentiment), Santiment (behavioral analytics), TradingView (charting), Token Terminal (financial metrics), and DeBank/Zapper (portfolios + Web3 social), new additions include:

- AI Forecasting: Platforms like IntoTheBlock and Messari Cortex use AI to identify patterns and predict prices.

- RWA & DePIN Analytics: Tools for evaluating tokenized real-world assets (RWA) and decentralized physical infrastructure networks (DePIN) are becoming critical.

- Risk Management: Solutions like Gauntlet for assessing DeFi protocol resilience are gaining popularity.

- No “Silver Bullet”: Combining social sentiment, on-chain data, and technical analysis (TA) remains the smartest way to build a complete market picture and avoid superficial signals. This is more relevant in 2025 than ever.

- Selection Criteria Have Evolved:

- Usability (UX): Still key.

- Accessibility: Free tiers for testing are a must-have.

- Asset Coverage: Now includes RWA, DePIN, memecoins, and L3 solutions.

- Integration & API: Ability to connect tools into a unified workflow.

- AI Insights: Using AI to process big data and generate forecasts.

- Trend: Personalization & Social Features: Tools like DeBank and Arkham increasingly focus on Web3 social aspects and personalized dashboards.

Table best crypto research tools in 2025

| Tool | Main Focus | Key Features (2025) | Best For | Pricing |

|---|---|---|---|---|

| Glassnode | On-chain Analytics | MVRV Z-Score, SOPR, wallet clustering, AI module Horizon, advanced RWA analytics | Institutions, analysts, funds | Free (basic), Advanced $49/mo, Pro from $833/mo, Institutional (custom) |

| Nansen | Smart Money + On-chain | Wallet labels, fund tracking, NFT analytics, real-time “Smart Money” alerts | Traders, funds, NFT investors | Free (limited), Pioneer from $99/mo, Pro $999/mo |

| Arkham | Deanonymization | Wallet owner identification, Web3 social graph, cross-chain entity mapping | Analysts, traders, journalists | Free (basic), paid tiers from $65/mo |

| CoinGecko | Aggregator | Prices, market data, NFT tracker, API, AI-powered market summaries | Beginners, investors | Free, Premium $9.99/mo |

| CoinMarketCap | Aggregator | Rankings, news, API, portfolio, institutional-grade data feeds | Beginners | Free, API from $29/mo |

| TradingView | Technical Analysis | Advanced charts, institutional-grade indicators, AI pattern recognition | Day traders, investors | Free (limited), Pro from $29.95/mo |

| LunarCrush | Social Sentiment | AI-driven sentiment analysis across 15+ platforms, narrative tracking | Traders, marketers | Free, Pro from $30/mo |

| Santiment | Behavioral Analytics | Advanced social + on-chain metrics, institutional flow tracking | Analysts, investors | Free (limited), Pro $49/mo |

| Token Terminal | Fundamentals | Protocol financials, revenue, P/S, developer activity, benchmarked against traditional finance metrics | Investors, funds | Free (limited), Pro $350/mo |

| DeBank | Portfolios + Web3 Social | Multi-chain wallet tracking, DeFi analytics, integrated social features | DeFi traders, communities | Free |

| Zapper | DeFi Portfolios | Real-time asset valuation, cross-chain dashboards, gas optimization | DeFi beginners | Free |

| IntoTheBlock | AI Analytics | Advanced predictive models, institutional vs retail flow analysis | Traders, AI enthusiasts | Free (limited), Advanced $15/mo |

| Messari Cortex | AI Research | NLP queries, institutional-grade reports, protocol comparison, RWA/DePIN trends | Analysts, funds, researchers | Enterprise only ($4998/year) |

| Gauntlet | Risk Management | Real-time DeFi stress testing, AI-driven parameter optimization | DAOs, institutions | Custom (project-focused) |

| DeFiLlama | DeFi Aggregator | TVL analytics, yield comparisons, multichain protocol monitoring | DeFi traders | Free |

| CertiK | Security | AI-powered audits, real-time threat detection, on-chain monitoring | All users | Free scan, Enterprise plans from $5k/mo |

Crypto Analysis Essentials: The 4 Pillars You Need in 2025

Before diving into what makes a tool great, let’s ground ourselves in the core methods of understanding the crypto market. In 2025, relying on just one approach is like navigating with a broken compass. The edge comes from combining these four pillars:

- Technical Analysis (TA): Charting the Course. This is the art of reading price charts, patterns, and indicators to forecast future movements. Think support/resistance, moving averages, RSI.

- 2025 Reality: “TA + AI is table stakes, not a luxury. Tools like IntoTheBlock leverage machine learning to spot signals faster than human reflexes allow, turning raw data into predictive insights for evaluating altcoin TA technical analysis sites.”

- 2025 Reality: “TA + AI is table stakes, not a luxury. Tools like IntoTheBlock leverage machine learning to spot signals faster than human reflexes allow, turning raw data into predictive insights for evaluating altcoin TA technical analysis sites.”

- Fundamental Analysis (FA): Digging Deeper Than the Token. This focuses on the intrinsic value: tokenomics, the team’s expertise, the product’s utility, market fit, and financials.

- 2025 Reality: “The rise of RWA (Real World Assets) and DePIN (Decentralized Physical Infrastructure) forces us to analyze the business behind the token. Is the revenue model sustainable? What’s the real-world asset backing? Platforms like Token Terminal and Messari Cortex have become indispensable best altcoin research tools for this deep dive.”

- On-Chain Analytics: Following the Smart Money. This examines the raw, immutable data on the blockchain: wallet activity, token flows, miner behavior, exchange inflows/outflows.

- 2025 Reality: “It’s not just about numbers; it’s about decoding the narrative of capital. Where is liquidity moving? Who are the ‘smart money’ players accumulating? Platforms like Nansen and Arkham lead the pack as best crypto analytics dashboards for translating blockchain whispers into actionable intelligence.”

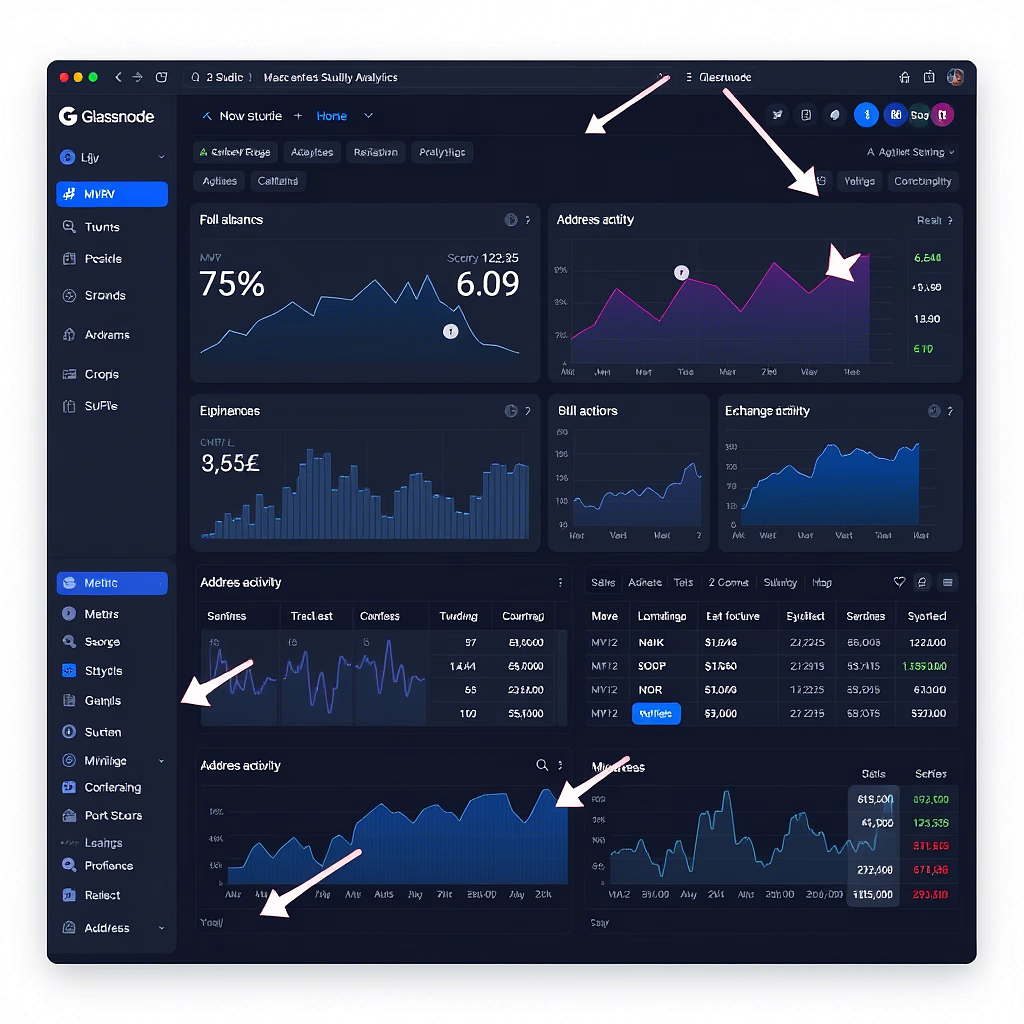

- (Визуальная вставка: Скриншот MVRV Z-Score на Glassnode/Dune)

- “Visualizing complex metrics like MVRV Z-Score (shown above) becomes intuitive with platforms like Glassnode or Dune, making even advanced on-chain analysis accessible.”

- Social Sentiment & Narrative Tracking: Gauging the Market Pulse. This measures the hype, fear, and overall mood across social media, news, and forums.

- 2025 Reality: “Web3-native social platforms like DeBank Frens offer unfiltered community pulse checks, revealing the narratives actually driving trends. LunarCrush and Santiment remain vital crypto research tools for quantifying the buzz and spotting potential manias or capitulation.”

The 2025 Edge: Cross-Analysis is King.

“Forget silver bullets. No single method – not even the shiniest AI tool – gives the full picture. Your sustainable advantage in 2025 comes from consciously weaving together TA, FA, On-Chain, and Sentiment analysis, powered by the best crypto research tools in 2025. It’s the synergy that uncovers true alpha.”

What Makes a Crypto Analysis Tool Truly Great in 2025?

Not all crypto tools are created equal. Some are feature-packed but unusable. Others look sleek but lack quality data. Here’s what truly matters now:

- Trusted Data: The absolute foundation. If data is flawed, everything crumbles. A good tool provides clean, consistent information you can rely on: token prices, on-chain metrics, wallet activity, RWA liquidity data, or DePIN network metrics. Transparency in sources and calculation methodology is critical.

- Real-Time + Historical Data: Markets change instantly, so live data is essential. But knowing what’s happening now isn’t enough—you need a view into the past to identify patterns, compare cycles, and understand long-term trends. The best tools offer both, with multi-timeframe analysis capabilities.

- Ease of Use (UX): Even the most powerful tool is useless if it’s hard to navigate. Clean layouts, intuitive charts, and smooth interfaces are key. You should get the information you need without feeling like you’re digging through an Excel spreadsheet. Intuitiveness equals efficiency.

- Wide Asset Coverage: Bitcoin and Ethereum are just the start. Top tools cover NFTs, DeFi, L2/L3 chains, stablecoins, memecoins, RWA, DePIN, and small-cap altcoins. You need the ability to deep-dive into any asset, not just the top 5. Versatility is a competitive edge.

- Custom Views & Alerts: The ability to tailor the tool to your needs is invaluable. Want to track whale movements? Monitor token unlocks? Get alerts for volume spikes or social media activity? Tools allowing custom alerts and dashboards save time and keep you ahead. Personalization equals efficiency.

- AI Integration: In 2025, tools using artificial intelligence to analyze big data, identify complex patterns, and generate forecasts or trading signals are becoming standard for professionals. Look for platforms offering not just data, but insights.

- Free vs. Paid Access: You shouldn’t have to pay just to test the waters. The best tools offer enough in their free tier to truly explore. If you like what you see, premium should add depth and exclusive features (advanced metrics, historical data, priority API)—not lock down core functionality. Try before you buy is smart.

On-Chain Analytics: Seeing Under the Blockchain’s Hood

If you want to see what’s really happening under the blockchain’s hood, on-chain analytics tools are your best friend. They track wallet activity, follow large transfers (“whales”), and reveal trends not obvious on price charts. Here are the top 2025 platforms turning raw blockchain data into clear, actionable insights.

Glassnode: Institutional Powerhouse

Glassnode remains a top-tier blockchain data and analytics platform, helping investors, traders, and researchers understand the digital market with surgical precision. Combining on-chain analytics with off-chain financial data, it delivers unparalleled insights into the wild world of crypto.

2025 Features

- Data Integration: Combines blockchain metrics with spot and derivatives market data for a holistic asset view. Added support for RWA data analysis.

- Glassnode Studio: Intuitive analytics suite with customizable, no-code dashboards and charts for visualizing fundamental asset metrics and liquidity dynamics. Improved UX for beginners.

- Glassnode Insights: Expert research hub with market updates, custom analysis, and educational content. Focus on cross-market analysis (crypto-traditional markets).

- High-Performance API: Seamless integration for trading models, portfolio strategies, and custom dashboards. Speed and reliability prioritized.

- Specialized Metrics & Clustering: Proprietary analytics, including wallet clustering and capital flow tracking, provide deep insights into participant behavior and market structure. Expanded clustering for L2/L3.

- Institutional Solutions: Custom tools and research packages for fund managers, analysts, and large content producers. Focus on compliance and reporting.

- New in 2025: Glassnode Horizon – experimental module with AI-powered forecasts of market cycles based on on-chain patterns.

Pros (Updated):

- Deep insights for Bitcoin, Ethereum, and other major assets.

- Trusted by leading TradFi and crypto institutions.

- User-friendly dashboards requiring no coding.

- Option to request custom research.

- Built by experts renowned for blockchain analytics innovation.

- Horizon AI module (beta) for advanced users.

Cons (Updated):

- Can be complex for beginners (despite UX improvements).

- Advanced features and deep history require paid subscription. AI module only for Pro+ tiers.

- Coverage of some new L3 and niche DePIN/RWA assets may be limited.

Pricing (Updated June 2025):

Important: Prices may change. Always verify current pricing on Glassnode’s website.

- Standard (Free): Basic on-chain data, access to core network and market metrics.

- Advanced ($59/month billed annually): Deep analysis, advanced on-chain metrics, basic derivatives data. Includes partial RWA data access.

- Professional ($899/month billed annually): Full access to sophisticated on-chain, derivatives, and spot metrics. High-precision data, entity-adjusted metrics, cutting-edge tools. Includes early access to Glassnode Horizon (AI).

- Institutional (Custom Pricing): Solutions for hedge funds, family offices. Integrations, custom reports, SLA.

Ideal for: Institutional investors, quant traders, on-chain analysts, hedge funds seeking an AI edge.

New Section: AI, RWA & DePIN Analytics – 2025 Trends

Crypto analytics isn’t standing still. Here are tools gaining traction in 2025:

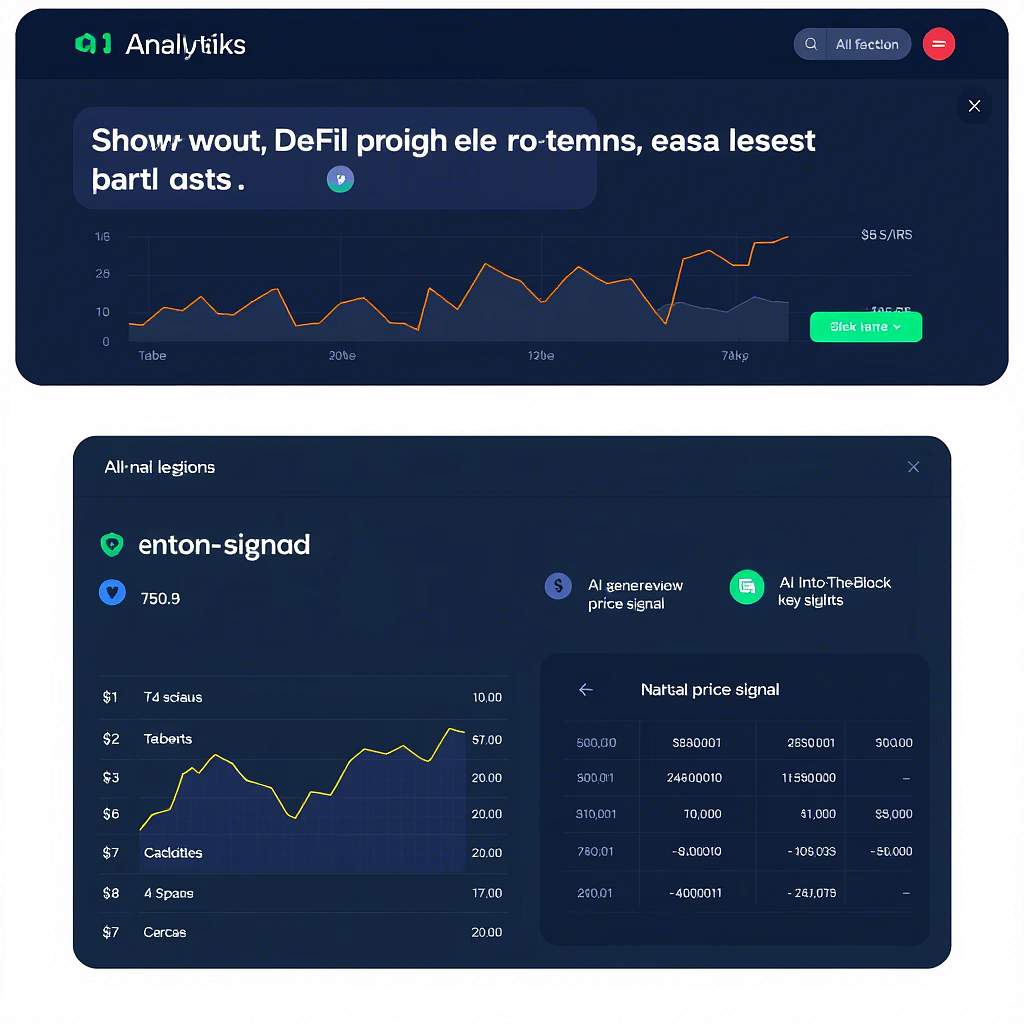

- IntoTheBlock (ITB):

- Focus: AI-powered price forecasting, identification of support/resistance clusters based on on-chain data, analysis of whale vs. retail activity.

- Key Features: “Predictive Signals”, liquidity visualization, market sentiment indicators. TradingView integration.

- For Whom: Traders seeking an AI edge; investors evaluating entry/exit points.

- Pricing: Freemium model. Pro from $50/month (billed annually).

- Messari Cortex:

- Focus: Research AI assistant. Analyzes mountains of data (on-chain, social, news, reports) to answer complex questions, generate reports, identify narratives. Particularly strong in emerging segments (RWA, DePIN).

- Key Features: Natural language queries (“Show me DeFi protocols with the highest revenue and lowest P/S Ratio”), protocol comparisons, trend analytics.

- For Whom: Researchers, analysts, content creators, asset managers.

- Pricing: Included in Messari Enterprise subscription (from $10,000/year).

- Gauntlet:

- Focus: Risk management and simulation for DeFi. Assesses protocol resilience (Aave, Compound, etc.) to market volatility, attacks, parameter changes.

- Key Features: Stress test simulations, protocol parameter optimization recommendations (rates, collateral), pool health monitoring. Critical for institutional DeFi investors.

- For Whom: Protocol developers, DAOs, large DeFi investors.

- Pricing: Custom solutions, oriented towards protocols and institutions.

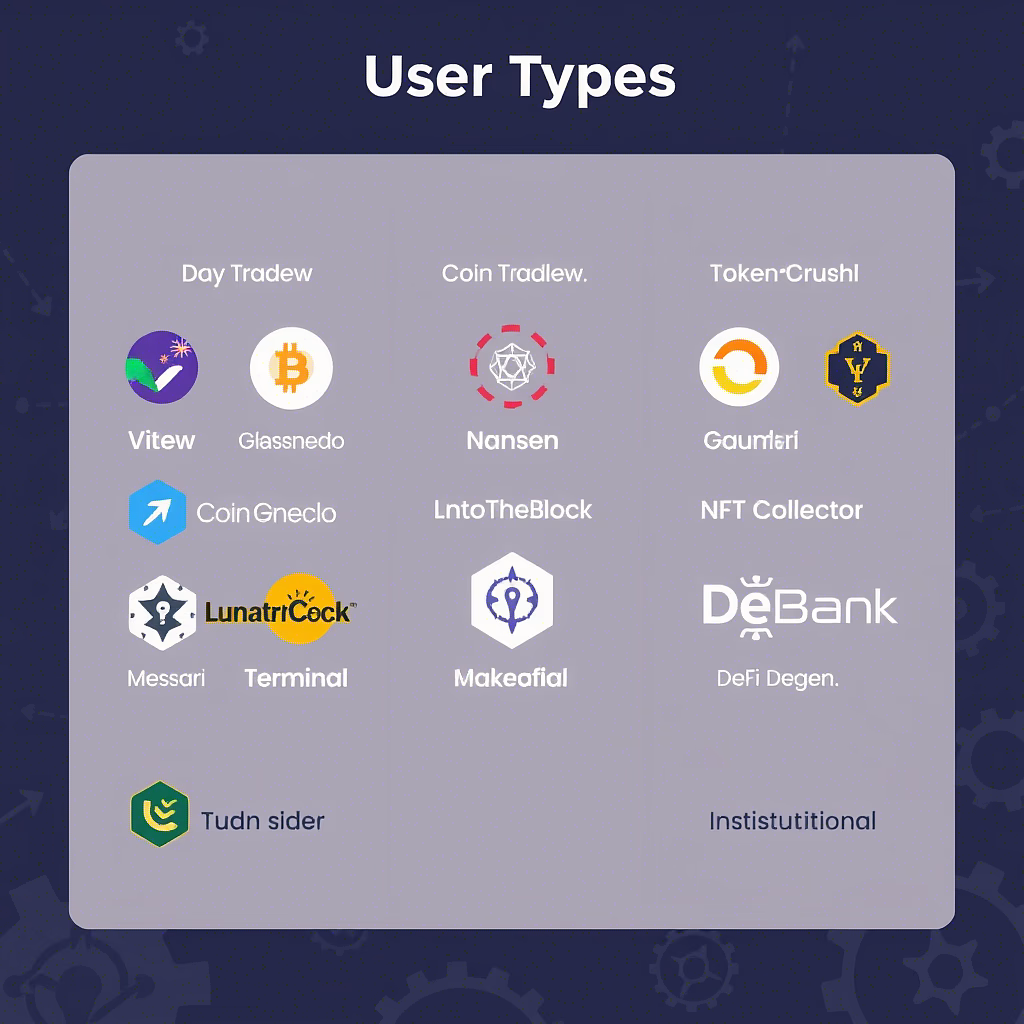

How to Choose Your Ideal Toolset in 2025? (Expanded & Focused)

Choosing isn't just about features; it's about matching tools to your goals and skills. Here’s your 2025 roadmap:

| User Type | Key Priorities | Example Toolset (2025) | Core Skills / What to Learn |

|---|---|---|---|

| Day Trader | Speed, real-time data, TA, alerts, order flow, sentiment | TradingView, CoinGecko Pro, LunarCrush Pro, IntoTheBlock (AI) | Candlesticks, RSI, MACD, AI signals, risk management, order book reading |

| Investor (Long-Term) | FA, on-chain metrics, protocol finances, dev activity, macro | Glassnode, Token Terminal, Santiment, Messari Cortex | Tokenomics, team analysis, RWA valuation, macro DePIN trends |

| NFT Collector/Trader | NFT trends, rarity, floor price, wallet tracking, social hype | CoinGecko NFT, Nansen (NFT), LunarCrush (NFT), DeBank/Zapper | Rarity, social sentiment, floor dynamics, whale wallets, narratives |

| DeFi Degen / Builder | Pool risk, APY, TVL, activity, audits, simulations | DeFiLlama, Gauntlet, Token Terminal, CertiK | TVL analysis, liquidation risks, audit reading, risk simulation, sustainability |

| Institutional Investor | Compliance, institutional-grade data, RWA, AI analytics | Glassnode Pro, Nansen Pro, Messari Enterprise, Gauntlet | Advanced FA/TA, RWA/DePIN due diligence, risk modeling, AI analytics (Cortex) |

New to Crypto Analysis in 2025? Start Here:

The barrier to entry is lower than ever, thanks to smarter tools. Jumpstart your learning:

- Master the 4 Pillars: Understand the core concepts of TA, FA, On-Chain, and Sentiment analysis.

- Learn the Lingo: Grasp basics like candles, support/resistance, volume, TVL, tokenomics.

- Leverage Free Tier Power: Start with free online tools to analyze crypto performance like TradingView (charts), CoinGecko (data), Glassnode (basic on-chain).

- Cross-Check Religiously: Never trust a single source. Compare data points.

- Graduate to AI & Real-World Data: As you progress, explore AI interfaces (like Messari Cortex) and tools for RWA/DePIN.

- Use Built-In Learning: Dive into the educational hubs within platforms like TradingView Education, Glassnode Learn, and Messari Research.

Cross-Verification – Your Golden Rule:

Never rely on a single data source! Bullish social sentiment (LunarCrush) might contradict exchange outflows (Glassnode) or a bearish technical pattern (TradingView). The smart approach combines:

- Social Sentiment & Narratives: Measures “noise,” hype, and public mood (LunarCrush, Santiment). Helps understand crowd psychology.

- On-Chain Analytics: Shows real user actions on-chain – fund movements, address activity, holder behavior (Glassnode, Nansen, Arkham). Shows what they do, not what they say.

- Technical Analysis (TA): Analyzes price and volume history to forecast future moves (TradingView). Helps with timing entries/exits and risk management.

- Fundamental Metrics: Assesses protocol financial health and potential (Token Terminal, Messari). Key to long-term value.

- AI Insights: Uses machine learning to uncover hidden patterns and generate hypotheses (IntoTheBlock, Messari Cortex). Adds a confirmation layer.

This layered approach significantly boosts confidence in your decisions and helps avoid traps based on superficial signals or FOMO/FUD.

Conclusion: Building Your Multi-Layered Edge in 2025

The world of crypto analysis in 2025 isn’t just about reading charts anymore. It’s a complex ecosystem demanding fluency in AI interpretation, on-chain forensics, and the nuances of emerging markets like RWA and DePIN. Your toolkit needs to be as dynamic and layered as the market itself – alive, flexible, and constantly evolving.

The 2025 Alpha Formula:

TA + FA + On-Chain + Sentiment + AI + RWA/DePIN + Web3 Social → Sustainable Edge.

Forget finding a single “best crypto research tool” or “best altcoin analysis tool.” The power lies in curating a personalized stack – perhaps Glassnode’s on-chain depth combined with LunarCrush’s social radar, supercharged by Messari Cortex’s AI insights for RWA evaluation. This multi-faceted approach is how you cut through the noise, validate opportunities against the hype, and navigate the crypto markets not just with information, but with genuine conviction and speed.

Frequently Asked Questions (FAQ)

What is the best crypto analysis tool in 2025?

There’s no single winner! The best tool depends on your goals. For TA – TradingView. For on-chain – Glassnode or Nansen. For social sentiment – LunarCrush. For protocol fundamentals – Token Terminal. The key is combining tools from different categories (on-chain + TA + sentiment) + adding AI analytics (IntoTheBlock, Messari Cortex).

How to track “Smart Money” in crypto?

The best tools are Nansen (its “Smart Money” feature is iconic) and Arkham (wallet tracker and entity mapping). They use sophisticated clustering and wallet labeling to identify and track successful funds, market makers, and experienced traders. (Learn more about Smart Money)

How to best research cryptocurrency before investing?

Use a multi-layered approach:

Fundamental Analysis (FA): Study the Whitepaper, team, tokenomics, use case, competitors (use CoinGecko, Messari, Token Terminal for data).

Technical Analysis (TA): Analyze price charts, volume, indicators to assess trend and entry points (TradingView).

On-Chain Analysis: Check network activity, token distribution, holder behavior, exchange flows (Glassnode, Nansen, Santiment).

Social Sentiment & News: Gauge community mood and media coverage (LunarCrush, Santiment).

Security & Audits: Ensure the protocol is audited by reputable firms (CertiK Skynet, DeFiYield REKT Database).

Macro Factors: Consider overall financial market conditions and regulation (CoinDesk Markets, The Block).

Where to find reliable crypto data and analytics?

Aggregators: CoinGecko, CoinMarketCap (basic data, rankings).

On-Chain Analytics: Glassnode, Nansen, Arkham, Santiment (deep blockchain data).

Social Sentiment: LunarCrush, Santiment.

Technical Analysis: TradingView.

Protocol Finances: Token Terminal, Messari.

News & Research: Messari, The Block, Cointelegraph, Decrypt, official protocol blogs.

AI Analytics: IntoTheBlock, Messari Cortex.

Security: CertiK, DeFiYield.

Critical Tip: Always cross-check information across multiple independent sources! (Investopedia Crypto Basics)1

What are the best free crypto analysis tools?

Many top tools have useful free tiers:

CoinGecko / CoinMarketCap (basic data, tracking).

Glassnode (basic on-chain metrics).

TradingView (basic charts/indicators with delayed data).

Santiment (limited metric set).

DeBank / Zapper (basic portfolio tracking).

LunarCrush (limited social metrics).

Token Terminal (historical blockchain data).

Important: Free tiers are often limited in features, data depth, or real-time access. Serious analysis usually requires paid plans.

I’m just starting out. Where do I begin with crypto analysis in 2025?

Welcome! The landscape in 2025 is more accessible but also broader. Here’s your launchpad:

Grasp the Core Methods: Understand the 4 pillars: Technical Analysis (TA), Fundamental Analysis (FA), On-Chain Analysis, and Social Sentiment. Know what each reveals.

Build Foundational Knowledge: Learn the absolute basics: candle patterns, key support/resistance levels, trading volume, what TVL means, core tokenomics concepts.

Leverage Free & Friendly Tools: Start with powerful free tiers: TradingView for charting basics, CoinGecko or CoinMarketCap for prices and data, Glassnode (free tier) for core on-chain metrics. These are top crypto research tools in 2025 for beginners.

Cross-Verify Constantly: Get in the habit early: Does the social hype (LunarCrush) match on-chain accumulation (Glassnode basics)? Does a TA pattern (TradingView) align with the project’s fundamentals (CoinGecko/Messari overviews)?

Progress Gradually: As you get comfortable, explore AI-powered insights (like IntoTheBlock’s free signals) and delve into tools focused on RWA and DePIN analysis.

Use Embedded Learning: Take advantage of educational resources within platforms: TradingView’s tutorials, Glassnode Learn, Messari’s research library. Many best crypto research tools in 2025 now offer intuitive learning paths.

2025 Bonus: Embrace AI Interfaces: Platforms like Messari Cortex are designed to explain complex concepts simply. Don’t be afraid to ask an AI research assistant “dumb” questions – it’s one of the best ways to research crypto in 2025 efficiently.

What are cryptanalysis tools?

Cryptanalysis tools can be software and platforms. They provide investors with data and information to analyze the cryptocurrency market. These tools use algorithms and data sources to track market trends, historical data, and technical indicators.

Why are cryptanalysis tools necessary?

Cryptanalysis tools are essential for understanding the market. They help investors make the right decisions based on accurate data and analysis. These tools help provide insight into market trends, price forecasts, and potential investment opportunities.

What types of cryptanalysis tools are available?

There are different types of cryptanalysis tools. These are chart analysis, chart analysis, and technical analysis tools. Each type serves its own purpose. analyzing various aspects of the market can provide valuable information to investors.

How do cryptanalysis tools work?

Cryptanalysis tools work by analyzing market data, historical price data, and technical indicators using algorithms and data sources. The tools provide visual representations, charts, and graphs. They help investors to understand market trends correctly and make informed decisions.

How can I choose the best cryptanalysis tools?

When choosing cryptanalysis tools, consider factors such as accuracy, ease of use, and compatibility with various cryptocurrencies. Suggested specific functions and features. It is also important to choose the tools that match your investment strategy and goals.

What is cryptographic graph analysis?

Cryptographic graph analysis focuses on analyzing price trends and patterns using graphical representations. This helps investors visualize market movements. identify potential opportunities and risks based on patterns.

What is cryptographic analysis?

Chart analysis is the analysis of historical price data. By studying graphical models and indicators, investors can gain insight into market trends, support and resistance levels, as well as potential entry or exit points for their investments.

How does analyzing cryptocurrency charts help with investments?

Analyzing cryptocurrency charts helps to understand the general logic and behavior of cryptocurrencies. By analyzing price movements, you can make predictions and identify potential buying or selling opportunities.

How does analyzing cryptocurrency charts help in making investment decisions?

Chart analysis helps analyze historical price data and identify patterns or signals that help determine investment decisions. By studying different types of charts and indicators, you can make more informed choices based on past market behavior.

Why is cryptographic analysis important?

Technical analysis is important, it helps to assess market conditions, find trends, and make the right investment decisions based on the data. By studying technical indicators and patterns, investors can better understand market sentiment and potential price movements.

How to apply technical analysis methods in the cryptocurrency market?

To apply technical analysis methods in the cryptocurrency market, you can use tools such as support and resistance levels, trend lines, moving averages, and various graphical models. These methods can help identify potential entry or exit points for investments.

What are the most popular cryptanalysis tools and platforms?

Popular cryptanalysis tools and platforms are CoinMarketCap, TradingView, Coinigy, and CryptoCompare. These platforms offer features such as real-time data, charting tools, technical indicators, and portfolio management capabilities.

Why is market data important?

Market data as an analysis tool requires a lot of work and integration with exchanges, normalization of data, calculation of average prices and much more. this must be done continuously, without errors and inaccuracies.

Blockchain allows analysis tools to collect accurate market data. And by analyzing such data using charting tools and platforms, you can predict where the market is heading; therefore, you can make decisions based on knowledge.