The crypto market isn’t just moving fast—it’s moving at light speed. To not just survive but thrive, you need the right tools in your arsenal. Whether you’re a day trader glued to charts, a long-term investor digging into token fundamentals, or just trying to see where the whales are swimming, quality research tools make all the difference. But not all platforms are created equal. Some offer flashy dashboards with superficial data. Others hide gold beneath layers of complexity.

This guide cuts through the hype: We break down the best crypto market analysis tools for 2025 so you spend less time digging and more time taking smart action. We’ve not only updated the data but added key trends of the year, such as AI analytics, tools for RWA (Real World Assets), and decentralized ratings.

Key Updates for 2025

- Top Tools 2025: Alongside established players like Glassnode (institutional on-chain analytics), Nansen (“smart money” tracking), Arkham (deanonymization), CoinGecko/CoinMarketCap (aggregators), LunarCrush (social sentiment), Santiment (behavioral analytics), TradingView (charting), Token Terminal (financial metrics), and DeBank/Zapper (portfolios + Web3 social), new additions include:

- AI Forecasting: Platforms like IntoTheBlock and Messari Cortex use AI to identify patterns and predict prices.

- RWA & DePIN Analytics: Tools for evaluating tokenized real-world assets (RWA) and decentralized physical infrastructure networks (DePIN) are becoming critical.

- Risk Management: Solutions like Gauntlet for assessing DeFi protocol resilience are gaining popularity.

- No “Silver Bullet”: Combining social sentiment, on-chain data, and technical analysis (TA) remains the smartest way to build a complete market picture and avoid superficial signals. This is more relevant in 2025 than ever.

- Selection Criteria Have Evolved:

- Usability (UX): Still key.

- Accessibility: Free tiers for testing are a must-have.

- Asset Coverage: Now includes RWA, DePIN, memecoins, and L3 solutions.

- Integration & API: Ability to connect tools into a unified workflow.

- AI Insights: Using AI to process big data and generate forecasts.

- Trend: Personalization & Social Features: Tools like DeBank and Arkham increasingly focus on Web3 social aspects and personalized dashboards.

Crypto Analysis Essentials: The 4 Pillars You Need in 2025

Before diving into what makes a tool great, let’s ground ourselves in the core methods of understanding the crypto market. In 2025, relying on just one approach is like navigating with a broken compass. The edge comes from combining these four pillars:

- Technical Analysis (TA): Charting the Course. This is the art of reading price charts, patterns, and indicators to forecast future movements. Think support/resistance, moving averages, RSI.

- 2025 Reality: “TA + AI is table stakes, not a luxury. Tools like IntoTheBlock leverage machine learning to spot signals faster than human reflexes allow, turning raw data into predictive insights for evaluating altcoin TA technical analysis sites.”

- Fundamental Analysis (FA): Digging Deeper Than the Token. This focuses on the intrinsic value: tokenomics, the team’s expertise, the product’s utility, market fit, and financials.

- 2025 Reality: “The rise of RWA (Real World Assets) and DePIN (Decentralized Physical Infrastructure) forces us to analyze the business behind the token. Is the revenue model sustainable? What’s the real-world asset backing? Platforms like Token Terminal and Messari Cortex have become indispensable best altcoin research tools for this deep dive.”

- On-Chain Analytics: Following the Smart Money. This examines the raw, immutable data on the blockchain: wallet activity, token flows, miner behavior, exchange inflows/outflows.

- 2025 Reality: “It’s not just about numbers; it’s about decoding the narrative of capital. Where is liquidity moving? Who are the ‘smart money’ players accumulating? Platforms like Nansen and Arkham lead the pack as best crypto analytics dashboards for translating blockchain whispers into actionable intelligence.”

- (Визуальная вставка: Скриншот MVRV Z-Score на Glassnode/Dune)

- “Visualizing complex metrics like MVRV Z-Score (shown above) becomes intuitive with platforms like Glassnode or Dune, making even advanced on-chain analysis accessible.”

- Social Sentiment & Narrative Tracking: Gauging the Market Pulse. This measures the hype, fear, and overall mood across social media, news, and forums.

- 2025 Reality: “Web3-native social platforms like DeBank Frens offer unfiltered community pulse checks, revealing the narratives actually driving trends. LunarCrush and Santiment remain vital crypto research tools for quantifying the buzz and spotting potential manias or capitulation.”

The 2025 Edge: Cross-Analysis is King.

“Forget silver bullets. No single method – not even the shiniest AI tool – gives the full picture. Your sustainable advantage in 2025 comes from consciously weaving together TA, FA, On-Chain, and Sentiment analysis, powered by the best crypto research tools in 2025. It’s the synergy that uncovers true alpha.”

What Makes a Crypto Analysis Tool Truly Great in 2025?

Not all crypto tools are created equal. Some are feature-packed but unusable. Others look sleek but lack quality data. Here’s what truly matters now:

- Trusted Data: The absolute foundation. If data is flawed, everything crumbles. A good tool provides clean, consistent information you can rely on: token prices, on-chain metrics, wallet activity, RWA liquidity data, or DePIN network metrics. Transparency in sources and calculation methodology is critical.

- Real-Time + Historical Data: Markets change instantly, so live data is essential. But knowing what’s happening now isn’t enough—you need a view into the past to identify patterns, compare cycles, and understand long-term trends. The best tools offer both, with multi-timeframe analysis capabilities.

- Ease of Use (UX): Even the most powerful tool is useless if it’s hard to navigate. Clean layouts, intuitive charts, and smooth interfaces are key. You should get the information you need without feeling like you’re digging through an Excel spreadsheet. Intuitiveness equals efficiency.

- Wide Asset Coverage: Bitcoin and Ethereum are just the start. Top tools cover NFTs, DeFi, L2/L3 chains, stablecoins, memecoins, RWA, DePIN, and small-cap altcoins. You need the ability to deep-dive into any asset, not just the top 5. Versatility is a competitive edge.

- Custom Views & Alerts: The ability to tailor the tool to your needs is invaluable. Want to track whale movements? Monitor token unlocks? Get alerts for volume spikes or social media activity? Tools allowing custom alerts and dashboards save time and keep you ahead. Personalization equals efficiency.

- AI Integration: In 2025, tools using artificial intelligence to analyze big data, identify complex patterns, and generate forecasts or trading signals are becoming standard for professionals. Look for platforms offering not just data, but insights.

- Free vs. Paid Access: You shouldn’t have to pay just to test the waters. The best tools offer enough in their free tier to truly explore. If you like what you see, premium should add depth and exclusive features (advanced metrics, historical data, priority API)—not lock down core functionality. Try before you buy is smart.

On-Chain Analytics: Seeing Under the Blockchain’s Hood

If you want to see what’s really happening under the blockchain’s hood, on-chain analytics tools are your best friend. They track wallet activity, follow large transfers (“whales”), and reveal trends not obvious on price charts. Here are the top 2025 platforms turning raw blockchain data into clear, actionable insights.

Glassnode: Institutional Powerhouse

Glassnode remains a top-tier blockchain data and analytics platform, helping investors, traders, and researchers understand the digital market with surgical precision. Combining on-chain analytics with off-chain financial data, it delivers unparalleled insights into the wild world of crypto.

2025 Features

- Data Integration: Combines blockchain metrics with spot and derivatives market data for a holistic asset view. Added support for RWA data analysis.

- Glassnode Studio: Intuitive analytics suite with customizable, no-code dashboards and charts for visualizing fundamental asset metrics and liquidity dynamics. Improved UX for beginners.

- Glassnode Insights: Expert research hub with market updates, custom analysis, and educational content. Focus on cross-market analysis (crypto-traditional markets).

- High-Performance API: Seamless integration for trading models, portfolio strategies, and custom dashboards. Speed and reliability prioritized.

- Specialized Metrics & Clustering: Proprietary analytics, including wallet clustering and capital flow tracking, provide deep insights into participant behavior and market structure. Expanded clustering for L2/L3.

- Institutional Solutions: Custom tools and research packages for fund managers, analysts, and large content producers. Focus on compliance and reporting.

- New in 2025: Glassnode Horizon – experimental module with AI-powered forecasts of market cycles based on on-chain patterns.

Pros (Updated):

- Deep insights for Bitcoin, Ethereum, and other major assets.

- Trusted by leading TradFi and crypto institutions.

- User-friendly dashboards requiring no coding.

- Option to request custom research.

- Built by experts renowned for blockchain analytics innovation.

- Horizon AI module (beta) for advanced users.

Cons (Updated):

- Can be complex for beginners (despite UX improvements).

- Advanced features and deep history require paid subscription. AI module only for Pro+ tiers.

- Coverage of some new L3 and niche DePIN/RWA assets may be limited.

Pricing (Updated June 2025):

Important: Prices may change. Always verify current pricing on Glassnode’s website.

- Standard (Free): Basic on-chain data, access to core network and market metrics.

- Advanced ($59/month billed annually): Deep analysis, advanced on-chain metrics, basic derivatives data. Includes partial RWA data access.

- Professional ($899/month billed annually): Full access to sophisticated on-chain, derivatives, and spot metrics. High-precision data, entity-adjusted metrics, cutting-edge tools. Includes early access to Glassnode Horizon (AI).

- Institutional (Custom Pricing): Solutions for hedge funds, family offices. Integrations, custom reports, SLA.

Ideal for: Institutional investors, quant traders, on-chain analysts, hedge funds seeking an AI edge.

New Section: AI, RWA & DePIN Analytics – 2025 Trends

Crypto analytics isn’t standing still. Here are tools gaining traction in 2025:

- IntoTheBlock (ITB):

- Focus: AI-powered price forecasting, identification of support/resistance clusters based on on-chain data, analysis of whale vs. retail activity.

- Key Features: “Predictive Signals”, liquidity visualization, market sentiment indicators. TradingView integration.

- For Whom: Traders seeking an AI edge; investors evaluating entry/exit points.

- Pricing: Freemium model. Pro from $50/month (billed annually).

- Messari Cortex:

- Focus: Research AI assistant. Analyzes mountains of data (on-chain, social, news, reports) to answer complex questions, generate reports, identify narratives. Particularly strong in emerging segments (RWA, DePIN).

- Key Features: Natural language queries (“Show me DeFi protocols with the highest revenue and lowest P/S Ratio”), protocol comparisons, trend analytics.

- For Whom: Researchers, analysts, content creators, asset managers.

- Pricing: Included in Messari Enterprise subscription (from $10,000/year).

Example of an AI-driven analytics dashboard where users interact with blockchain data using natural language queries — revealing actionable insights and visualizations.

- Gauntlet:

- Focus: Risk management and simulation for DeFi. Assesses protocol resilience (Aave, Compound, etc.) to market volatility, attacks, parameter changes.

- Key Features: Stress test simulations, protocol parameter optimization recommendations (rates, collateral), pool health monitoring. Critical for institutional DeFi investors.

- For Whom: Protocol developers, DAOs, large DeFi investors.

- Pricing: Custom solutions, oriented towards protocols and institutions.

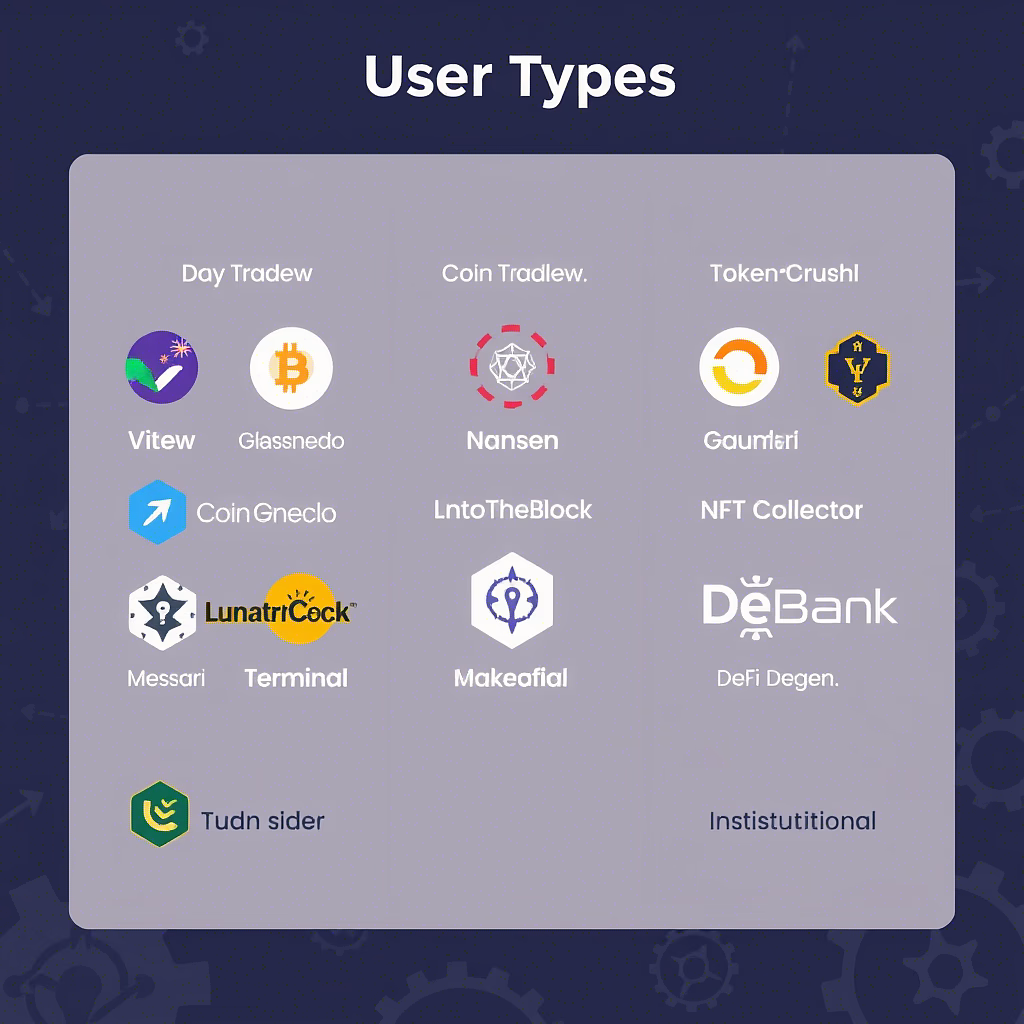

How to Choose Your Ideal Toolset in 2025? (Expanded & Focused)

Choosing isn't just about features; it's about matching tools to your goals and skills. Here’s your 2025 roadmap:

| User Type | Key Priorities | Example Toolset (2025) | Core Skills / What to Learn |

|---|---|---|---|

| Day Trader | Speed, real-time data, TA, alerts, order flow, sentiment | TradingView, CoinGecko Pro, LunarCrush Pro, IntoTheBlock (AI) | Candlesticks, RSI, MACD, AI signals, risk management, order book reading |

| Investor (Long-Term) | FA, on-chain metrics, protocol finances, dev activity, macro | Glassnode, Token Terminal, Santiment, Messari Cortex | Tokenomics, team analysis, RWA valuation, macro DePIN trends |

| NFT Collector/Trader | NFT trends, rarity, floor price, wallet tracking, social hype | CoinGecko NFT, Nansen (NFT), LunarCrush (NFT), DeBank/Zapper | Rarity, social sentiment, floor dynamics, whale wallets, narratives |

| DeFi Degen / Builder | Pool risk, APY, TVL, activity, audits, simulations | DeFiLlama, Gauntlet, Token Terminal, CertiK | TVL analysis, liquidation risks, audit reading, risk simulation, sustainability |

| Institutional Investor | Compliance, institutional-grade data, RWA, AI analytics | Glassnode Pro, Nansen Pro, Messari Enterprise, Gauntlet | Advanced FA/TA, RWA/DePIN due diligence, risk modeling, AI analytics (Cortex) |

New to Crypto Analysis in 2025? Start Here:

The barrier to entry is lower than ever, thanks to smarter tools. Jumpstart your learning:

- Master the 4 Pillars: Understand the core concepts of TA, FA, On-Chain, and Sentiment analysis.

- Learn the Lingo: Grasp basics like candles, support/resistance, volume, TVL, tokenomics.

- Leverage Free Tier Power: Start with free online tools to analyze crypto performance like TradingView (charts), CoinGecko (data), Glassnode (basic on-chain).

- Cross-Check Religiously: Never trust a single source. Compare data points.

- Graduate to AI & Real-World Data: As you progress, explore AI-интерфейсы (как у Messari Cortex) and tools for RWA/DePIN.

- Use Built-In Learning: Dive into the educational hubs within platforms like TradingView Education, Glassnode Learn, and Messari Research.

Cross-Verification – Your Golden Rule:

Never rely on a single data source! Bullish social sentiment (LunarCrush) might contradict exchange outflows (Glassnode) or a bearish technical pattern (TradingView). The smart approach combines:

- Social Sentiment & Narratives: Measures “noise,” hype, and public mood (LunarCrush, Santiment). Helps understand crowd psychology.

- On-Chain Analytics: Shows real user actions on-chain – fund movements, address activity, holder behavior (Glassnode, Nansen, Arkham). Shows what they do, not what they say.

- Technical Analysis (TA): Analyzes price and volume history to forecast future moves (TradingView). Helps with timing entries/exits and risk management.

- Fundamental Metrics: Assesses protocol financial health and potential (Token Terminal, Messari). Key to long-term value.

- AI Insights: Uses machine learning to uncover hidden patterns and generate hypotheses (IntoTheBlock, Messari Cortex). Adds a confirmation layer.

This layered approach significantly boosts confidence in your decisions and helps avoid traps based on superficial signals or FOMO/FUD.

Conclusion: Building Your Multi-Layered Edge in 2025

The world of crypto analysis in 2025 isn’t just about reading charts anymore. It’s a complex ecosystem demanding fluency in AI interpretation, on-chain forensics, and the nuances of emerging markets like RWA and DePIN. Your toolkit needs to be as dynamic and layered as the market itself – alive, flexible, and constantly evolving.

The 2025 Alpha Formula:

TA + FA + On-Chain + Sentiment + AI + RWA/DePIN + Web3 Social → Sustainable Edge.

Forget finding a single “best crypto research tool” or “best altcoin analysis tool.” The power lies in curating a personalized stack – perhaps Glassnode’s on-chain depth combined with LunarCrush’s social radar, supercharged by Messari Cortex’s AI insights for RWA evaluation. This multi-faceted approach is how you cut through the noise, validate opportunities against the hype, and navigate the crypto markets not just with information, but with genuine conviction and speed.

Frequently Asked Questions (FAQ)

1. What is the best crypto analysis tool in 2025?

- There’s no single winner! The best tool depends on your goals. For TA – TradingView. For on-chain – Glassnode or Nansen. For social sentiment – LunarCrush. For protocol fundamentals – Token Terminal. The key is combining tools from different categories (on-chain + TA + sentiment) + adding AI analytics (IntoTheBlock, Messari Cortex).

2. How to best research cryptocurrency before investing?

- Use a multi-layered approach:

- Fundamental Analysis (FA): Study the Whitepaper, team, tokenomics, use case, competitors (use CoinGecko, Messari, Token Terminal for data).

- Technical Analysis (TA): Analyze price charts, volume, indicators to assess trend and entry points (TradingView).

- On-Chain Analysis: Check network activity, token distribution, holder behavior, exchange flows (Glassnode, Nansen, Santiment).

- Social Sentiment & News: Gauge community mood and media coverage (LunarCrush, Santiment).

- Security & Audits: Ensure the protocol is audited by reputable firms (CertiK Skynet, DeFiYield REKT Database).

- Macro Factors: Consider overall financial market conditions and regulation (CoinDesk Markets, The Block).

3. Where to find reliable crypto data and analytics?

- Aggregators: CoinGecko, CoinMarketCap (basic data, rankings).

- On-Chain Analytics: Glassnode, Nansen, Arkham, Santiment (deep blockchain data).

- Social Sentiment: LunarCrush, Santiment.

- Technical Analysis: TradingView.

- Protocol Finances: Token Terminal, Messari.

- News & Research: Messari, The Block, Cointelegraph, Decrypt, official protocol blogs.

- AI Analytics: IntoTheBlock, Messari Cortex.

- Security: CertiK, DeFiYield.

- Critical Tip: Always cross-check information across multiple independent sources! (Investopedia Crypto Basics)

4. What are the best free crypto analysis tools?

- Many top tools have useful free tiers:

- CoinGecko / CoinMarketCap (basic data, tracking).

- Glassnode (basic on-chain metrics).

- TradingView (basic charts/indicators with delayed data).

- Santiment (limited metric set).

- DeBank / Zapper (basic portfolio tracking).

- LunarCrush (limited social metrics).

- Token Terminal (historical blockchain data).

- Important: Free tiers are often limited in features, data depth, or real-time access. Serious analysis usually requires paid plans.

5. How to track “Smart Money” in crypto?

- The best tools are Nansen (its “Smart Money” feature is iconic) and Arkham (wallet tracker and entity mapping). They use sophisticated clustering and wallet labeling to identify and track successful funds, market makers, and experienced traders. (Learn more about Smart Money)

6. I’m just starting out. Where do I begin with crypto analysis in 2025?

- Welcome! The landscape in 2025 is more accessible but also broader. Here’s your launchpad:

- Grasp the Core Methods: Understand the 4 pillars: Technical Analysis (TA), Fundamental Analysis (FA), On-Chain Analysis, and Social Sentiment. Know what each reveals.

- Build Foundational Knowledge: Learn the absolute basics: candle patterns, key support/resistance levels, trading volume, what TVL means, core tokenomics concepts.

- Leverage Free & Friendly Tools: Start with powerful free tiers: TradingView for charting basics, CoinGecko or CoinMarketCap for prices and data, Glassnode (free tier) for core on-chain metrics. These are top crypto research tools in 2025 for beginners.

- Cross-Verify Constantly: Get in the habit early: Does the social hype (LunarCrush) match on-chain accumulation (Glassnode basics)? Does a TA pattern (TradingView) align with the project’s fundamentals (CoinGecko/Messari overviews)?

- Progress Gradually: As you get comfortable, explore AI-powered insights (like IntoTheBlock’s free signals) and delve into tools focused on RWA and DePIN analysis.

- Use Embedded Learning: Take advantage of educational resources within platforms: TradingView’s tutorials, Glassnode Learn, Messari’s research library. Many best crypto research tools in 2025 now offer intuitive learning paths.

- 2025 Bonus: Embrace AI Interfaces: Platforms like Messari Cortex are designed to explain complex concepts simply. Don’t be afraid to ask an AI research assistant “dumb” questions – it’s one of the best ways to research crypto in 2025 efficiently.