So, what’s the big deal? Honestly, putting real-world stuff on the blockchain isn’t just a niche crypto thing anymore. We’ve hit a real turning point. This whole “Real-World Asset” (RWA) tokenization thing has ballooned into a market worth well over $25 billion. It’s fundamentally changing how we think about owning things, trading them, and who gets a piece of the pie. It’s a shift as big as when we all started using banking apps instead of going into the bank.

The growth has been, frankly, insane. We’re talking about a market that was just a tiny $85 million blip back in 2020. Then, boom—it exploded to over $25 billion by this past July. That’s a 245x jump in just a few years. But it’s not all been a smooth ride up. The market got a reality check later in the year, with the total value locked (TVL) bouncing around—hitting $26.59 billion in August and then dipping to $15.7 billion by September. It just goes to show this whole space is still super new and a bit shaky, moving with the whims of big money and whatever the regulators are thinking that week.

Chart: You’d see a wild hockey-stick curve here, going from almost nothing in 2020 to a massive peak in 2025, then a little dip.

So, What’s Really Driving This? It’s Not What You Think.

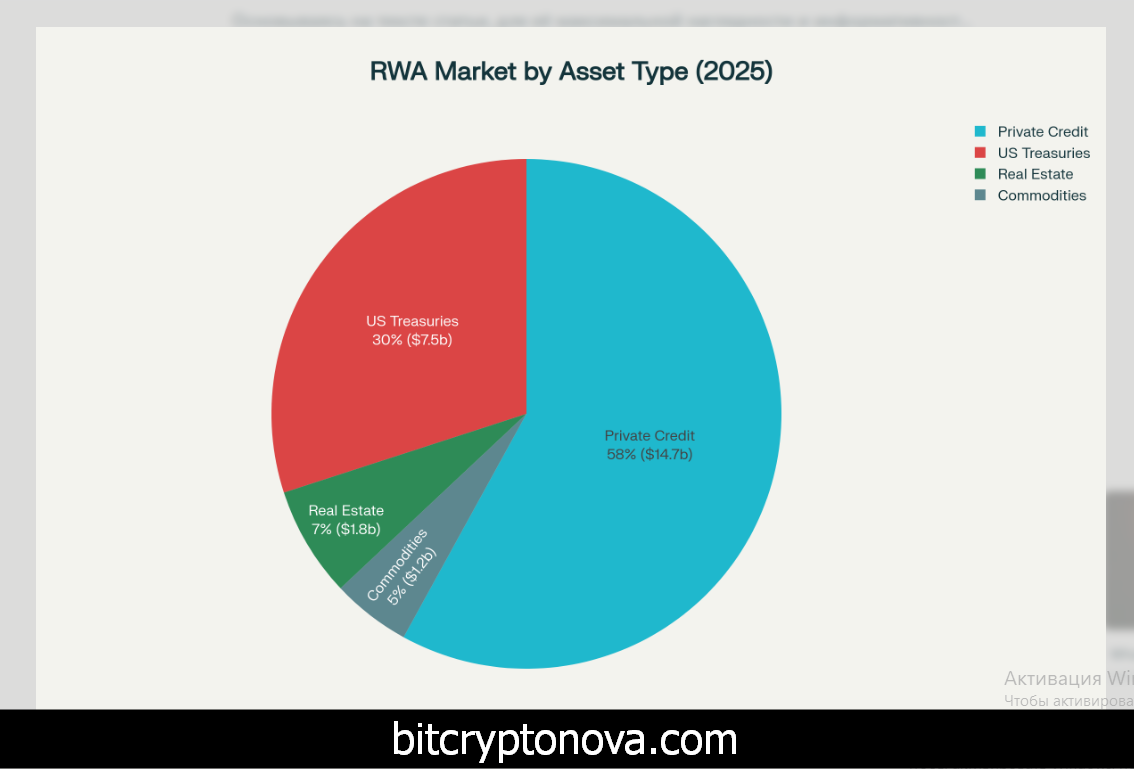

Forget the hype about tokenizing famous paintings or fancy apartments. That stuff gets headlines, but it’s not where the real money is. The data tells a totally different story. This market is all about the big, institutional players looking for steady, safe yield. You know, the boring stuff. Private credit is the monster here, making up $14.7 billion—that’s 58% of the whole market. Right behind it are tokenized U.S. Treasuries with another $7.5 billion.

Here’s how it all connects: That huge chunk of the market called “private credit”? Well, that’s where a project like Centrifuge comes in. They’re a huge reason that segment is so big. They let regular businesses turn their unpaid invoices into cash by tokenizing them. So, Centrifuge isn’t just playing in the biggest part of the RWA world; they’re actively building it by fixing a massive headache for small and medium-sized businesses.

| What’s Being Tokenized? | Market Size ($ Billions) | Slice of the Pie | Who’s the Big Player? | Why the Big Guys Care |

|---|---|---|---|---|

| Private Credit | $14.7 | 58% | Centrifuge | Funding businesses, earning yield |

| U.S. Treasuries | $7.5 | 30% | BlackRock BUIDL | Safe, regulated on-chain cash |

| Real Estate | $1.8 | 7% | A bunch of smaller ones | Splitting up properties |

| Commodities | $1.2 | 5% | Various | Hedging against inflation |

Why The Numbers Are So Messy: A Quick Reality Check

Trying to get a straight answer on market size is tough. Honestly, the wild swings in numbers aren’t just market panic. It’s also because everyone measures this stuff differently. Some data sites count all sorts of synthetic and derivative stuff, while others are stricter and only count actual tokenized assets. It makes a real apples-to-oranges comparison kind of difficult.

| Metric | Source 1’s Number | Source 2’s Number | Source 3’s Number | How Much They Differ | My Guess Why |

|---|---|---|---|---|---|

| Total RWA Market | $25B (July ’25) | $26.59B (Aug ’25) | $15.7B (Sep ’25) | A Lot | Some count derivatives, some don’t |

| Ethena’s TVL | $13B (Sep ’25) | $6.117B (Sep ’25) | N/A | A Huge Amount | Depends if you count the hedging bets |

| BlackRock’s BUIDL | $2.38B (Sep ’25) | $1.87B (Mar ’25) | ~$615M (Feb ’25) | Medium | This one’s just pure, fast growth |

| Tokenized Treasuries | $7.45B (Aug ’25) | $7.3B (Sep ’25) | $7.5B (Q2 ’25) | Not Much | Pretty clear-cut, so numbers align |

Let’s Bust a Myth: Tokenization ≠ Instant Liquidity

Okay, real talk. A lot of people hear “tokenization” and think it’s a magic wand for liquidity. It’s not. Turning your apartment building into a thousand tokens doesn’t mean a thousand buyers will magically appear.

Tokenization just gives you the potential for liquidity. It makes it possible to trade assets 24/7 and in tiny pieces. But if no one actually wants to buy your token, it’s just as illiquid as the physical asset was. You still need real demand, good trading platforms, and clear rules. We’ve seen this movie before—some studies show that most of these RWA tokens barely trade at all. People just hold them.

To get real liquidity, you need a few key things:

- People actually trading, so you know what a fair price is.

- Enough buyers and sellers so that big trades don’t crash the price.

- Professional “market makers” who are always ready to buy and sell.

- Rules that the big players can trust.

- And—this is a big one—systems that let you trade tokens across different blockchains.

The Standardization Crisis: Why the Big Money is Still Hesitant

This is the biggest roadblock, period. The fact that there’s no single “standard” for tokenizing assets is a massive headache for institutional investors. It’s like trying to build something with LEGOs, but every brick is from a different, incompatible set. It just doesn’t work at scale.

Right now, you have tokens on Ethereum using one standard (like ERC-20), while other blockchains have their own proprietary ways of doing things. This creates some serious problems for the big-money players.

The “Composability” Problem—Or, Why You Can’t Mix and Match

The big investment funds make their money by doing clever things with different assets—using real estate as collateral for a loan, for instance. But you can’t do that easily if your tokenized real estate is on one blockchain and your tokenized bonds are on another, and they don’t speak the same language. This inability to “compose” or stack assets together is a deal-breaker for trillions of dollars of institutional capital that needs that flexibility.Arbitrage Headaches

Market makers keep prices fair by buying an asset where it’s cheap and selling it where it’s expensive. But if the same tokenized Treasury bill is trading on both Ethereum and Solana, and you can’t easily move it between them, you can’t do that arbitrage. The result? Prices can be different on different platforms, and the “spread” (the difference between the buy and sell price) gets way too wide for big investors.Help is on the way, though…

Thankfully, some smart people are working on this. We’ve got things like:- Chainlink’s CCIP: A way to send messages between blockchains to create unified pools of money.

- Cosmos’s IBC: Basically a universal translator for blockchains.

- LayerZero: A framework that lets apps live on multiple blockchains at once.

- Polkadot’s Parachains: Lets people build specialized blockchains that are guaranteed to work together.

The Regulatory Maze: Laws, Rules, and Lawsuits

Navigating the rules for RWAs is a nightmare. The biggest question is still unanswered: is a token a security, a commodity, or something else entirely? The answer changes everything about who can buy it and what rules you have to follow.MiCA in Europe: A Glimmer of Clarity

Europe is actually way ahead of the game here. Their Markets in Crypto-Assets (MiCA) regulation, which is now fully in effect, sets clear rules. It even effectively bans purely algorithmic stablecoins, which is bad news for some projects but provides a ton of clarity for others. Under MiCA, you have to:- Back your stablecoins 1-to-1 with real cash.

- Face extra scrutiny if your token gets too popular.

- Be based in the EU to issue certain tokens.

- Follow a bunch of disclosure rules, just like a regular financial company.

When Code Meets the Courtroom: Real-World Legal Fights

The whole “code is law” idea is being tested in actual courtrooms, and the results are fascinating.Hong Kong’s High-Tech Court Order

There was this wild case in Hong Kong where a judge ordered a legal notice to be delivered as a token, airdropped directly into someone’s crypto wallet. It effectively froze $2.66 million. It shows that courts are getting creative and finding ways to enforce laws on the blockchain.Singapore Sets a Standard for Value

In another case, a Singapore court had to figure out how to value lost crypto for a lawsuit. They decided that the fairest way was to use the spot price on the day the mess-up happened. That sets a huge precedent for future disputes.The U.S. and DAO Liability—Ouch

And in the U.S., a judge made a ruling in a case involving Lido DAO that should make everyone nervous. Basically, the court said that if you hold a DAO’s governance tokens, you could be treated like a general partner in a business. That means you could be personally liable if the DAO gets sued. A huge risk.Grading the Players: My Quality Scorecard

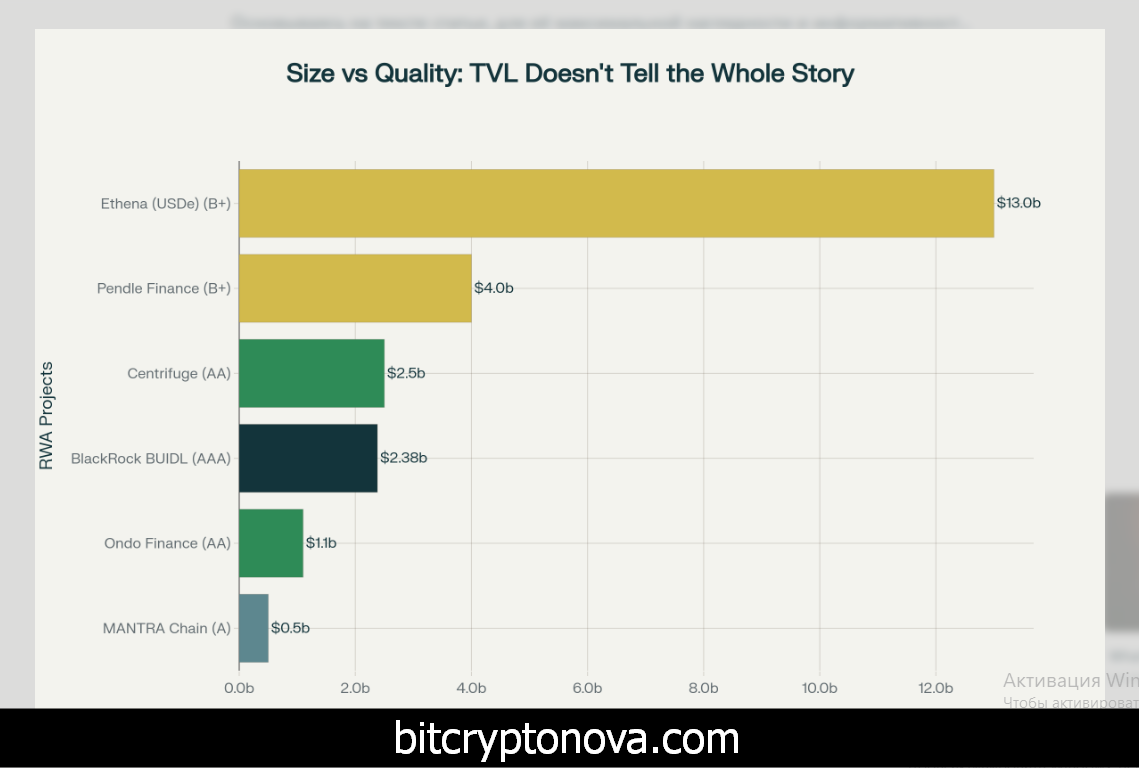

Let’s be real, TVL isn’t everything. You have to look at these projects like a real investor would. Here’s my breakdown of who’s actually building something solid versus who’s just riding the hype wave:

A Closer Look at the Market Leaders

BlackRock BUIDL: The 800-Pound Gorilla

BlackRock’s tokenized fund is the ultimate seal of approval for this whole space. At $2.38 billion, its growth from just $615 million back in February is a testament to how badly institutions wanted a safe, compliant way to get their cash on-chain. Why they’re winning with the big guys:- They’re on seven different blockchains but handle all the messy custody stuff behind the scenes.

- They’re plugged directly into the traditional banking system.

- You can get your money out daily, and the yield just shows up automatically—no fuss.

- It’s fully compliant with U.S. laws, which is a huge deal.

Centrifuge: The Engine of the Private Credit Boom

When a giant like Apollo Global Management partners with Centrifuge to tokenize a credit fund, you know something big is happening. Centrifuge has basically gone from a cool DeFi idea to a serious piece of institutional plumbing.The Leadership Link: Centrifuge isn’t just a platform; it’s the engine driving the entire $14.7 billion private credit market. They’re solving a real-world problem for businesses that need cash, and in doing so, they’re creating the biggest slice of the RWA pie.

What they do better than anyone:

- Give investors a real-time, transparent look at how loans are performing.

- Automate all the payment distributions, which saves a ton on admin costs.

- Provide an on-chain record of performance that lets people build better risk models.

- Plug into the tools that traditional credit analysts already use.

Ondo Finance: Bringing the Stock Market to the Blockchain

Ondo’s move to launch tokenized stocks and ETFs this September was a game-changer. The tokenized stock market is tiny right now—only about $424 million—but everyone thinks it could be a trillion-dollar market once the big brokerages get on board. Their big idea:- Let people outside the U.S. trade American stocks 24/7.

- Allow for fractional ownership of expensive stocks like Amazon or Apple.

- Reduce the risk and time it takes to settle trades.

- Let DeFi geeks use stocks as collateral for loans and other strategies.

MANTRA Chain: The Compliance-First Blockchain

MANTRA’s whole approach is to build the rules directly into the blockchain itself. It’s a clever way to deal with the patchwork of regulations around the world. And the fact that their tech now supports both Ethereum-style and Cosmos-style code makes them incredibly flexible.Solving the Legal Headache: By baking compliance right into the protocol, MANTRA makes it impossible to break the rules, not just against the rules. For a big institution worried about legal blowback, that’s a massive selling point.

Their secret sauce:

- KYC is checked when a transaction is validated, not after the fact.

- They automatically screen against sanctions lists in real-time.

- You can set up different rules for different countries.

- Everything leaves a perfect, auditable paper trail.

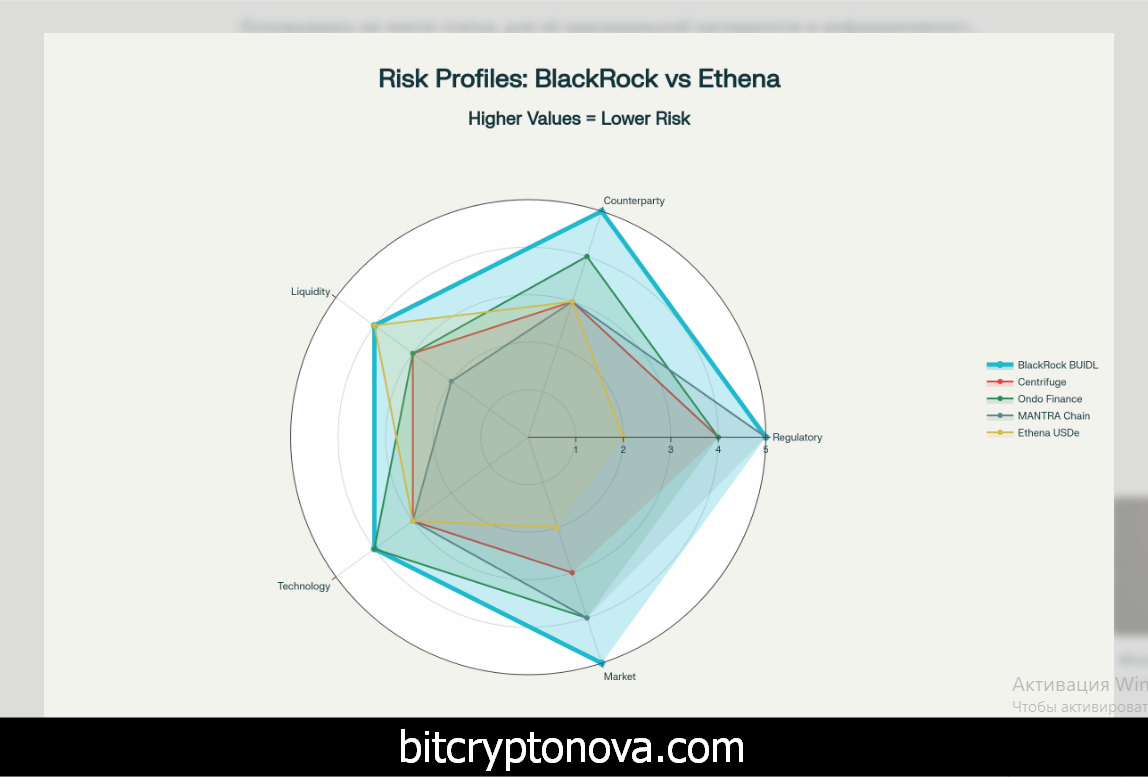

How the Big Players Assess Risk

The On-Chain Detectives: Why Compliance Tools Are a Big Deal

Let’s be honest, the only reason big money is even touching this stuff is because of the rise of sophisticated “blockchain forensics” tools. They’ve gone from a nice-to-have to an absolute necessity.The Professional-Grade Tooling

Chainalysis Reactor is basically the go-to for law enforcement and serious institutions. It lets you:- Literally watch the money move across 20+ different blockchains.

- Figure out who controls different clusters of wallets.

- Get a real-time risk score on any transaction.

- Automatically generate reports that hold up in court.

- Do deep background checks on wallets and transactions.

- Plug blockchain monitoring right into their existing compliance software.

- Keep records that will satisfy regulators anywhere.

- Set up automatic alerts for risky behavior.

Real-Time Decisions with TRM Labs

TRM Labs is all about speed. Their tool can give you a risk score on a wallet in less than half a second. This lets institutions do things like:- Approve or deny transactions instantly.

- Set their own risk tolerance.

- Analyze who owns a wallet and who they’ve been transacting with.

- Drill down multiple “hops” to see if clean money came from a dirty source.

Where Do We Go From Here? A Few Scenarios…

This whole RWA thing is at a crossroads. It’s moving out of the experimental phase and into the mainstream, but there are a few ways this could play out.Will the Big Banks Take Over?

The current model is crypto-native companies providing services to big banks. But that might not last. JPMorgan, Goldman Sachs, and BNY Mellon are all running their own tokenization projects. It’s not crazy to think they might just decide to do it all themselves in a couple of years.One Set of Rules, or a Mess of Them?

The dream scenario is that everyone agrees on a global set of rules, like MiCA, and everything becomes seamless. The more realistic scenario? We end up with regional blocks of rules—one for Europe, one for the U.S., one for Asia—and it’s a pain to move assets between them.The Tech Needs to Grow Up

For this to really take off, a few things have to happen:- We need a universal standard for what a “token” is.

- Assets need to move seamlessly between blockchains.

- Traditional, trusted custodians need to handle blockchain assets.

- It all needs to plug into the existing settlement and clearing systems.

Final Thoughts: The Inevitable, Messy Future of Finance

So yeah, RWA tokenization has come a long way. It’s a real, $25+ billion market now, and the fact that 88% of it is boring stuff like private credit and Treasuries proves that the big institutions are here to stay. It’s not about hype anymore; it’s about yield and efficiency. But my analysis shows that you can’t just look at the size of a project. Market cap is not a measure of quality. A project like BlackRock’s BUIDL is top-tier because it’s built for institutions, even if it’s smaller than a high-risk, high-reward protocol like Ethena. That’s the real story here—quality and compliance are what will win in the long run. The biggest challenge, in my opinion, is the tech infrastructure. The lack of a single standard is a killer for institutional strategies that rely on mixing and matching different assets. You can’t run a multi-trillion-dollar portfolio on a system that’s this fragmented and clunky. But we’re seeing the path forward. Projects like MANTRA (with its built-in compliance), BlackRock (with its direct institutional hooks), and Centrifuge (with its real-world business integration) are showing what the future looks like. They’re solving the hard problems. For investors, this is a massive opportunity, but it’s also a minefield. You have to do your homework. The huge market swings we saw this summer—a $10 billion drop in TVL—should be a wake-up call. Don’t chase momentum; look for quality. The tokenization revolution is happening, no doubt about it. But it’s going to be slower, more regulated, and more driven by the old guard of finance than the early crypto pioneers ever imagined. And understanding that is the key to navigating what comes next.Important Disclaimer: Look, this is just my analysis for educational purposes. This is not investment advice. Tokenized assets are super risky. You could lose all your money. The rules are changing all the time, smart contracts can have bugs, and markets are crazy volatile. Past performance means nothing. Please, do your own homework and talk to qualified financial and legal pros before you even think about putting money into this stuff. I’m not responsible for any decisions you make based on what you read here.